How It Works

We Deliver A Post-accident Option and Offer Pre-accident Value

Each Offer is personalized for you. This means we use real-time industry data, consider repair estimates, and review images to determine the accurate pre-accident value of your vehicle. Additionally, we integrate the repair estimate into our bid to purchase your vehicle, ensuring a comprehensive and fair bid to buy your repairable vehicle before repairs begin.

Once You Say "YES"

Once you accept the offer, you’ll have a dedicated ClaimBuyout team member assist you from start to finish.

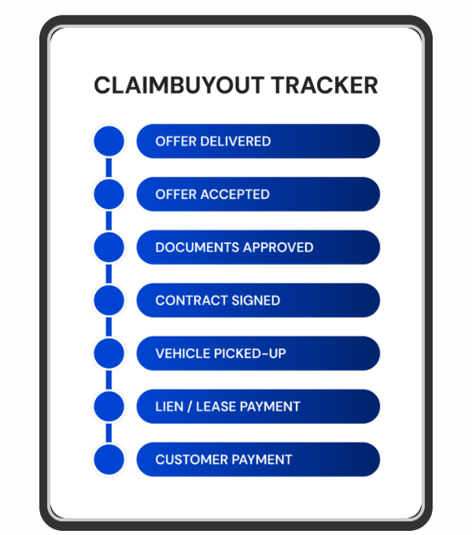

We've designed a ClaimBuyout Tracker so you can watch the status of your progress.

ClaimBuyout will provide you with written confirmation along with the terms and conditions.

We’ll dig deeper into payment details and lien information needed to satisfy all parties involved.

You provide your vehicle's title and paperwork to ClaimBuyout.

We’ll coordinate your vehicle’s pickup and delivery.

We’ll let you know when you will receive your check.

Recent Buyouts

Buyout: 2014 Jeep Wrangler Unlimited Rubicon

(South Easton, MA)

-

6% Damage

-

$12,000 Purchase Price

-

1 Day to Close (Offer to Contract)

- Clear-title vehicle

- Why ClaimBuyout? The owner didn't feel the vehicle would be repaired to pre-accident condition and didn't want to wait any longer given the months that it was already taking.

Buyout: 2010 Maserati Gran Turismo

(Walnut Creek, CA)

- 17% Damage

- $21,000 Purchase Price

- 1 Day to Close (Offer to Contract)

- Clear-title vehicle

- Why ClaimBuyout? The owner chose ClaimBuyout due to unavailable parts and delays.

Buyout: 2019 Chevrolet Corvette

(San Jose, CA)

-

4% Damage

-

$52,700 Purchase Price

-

1 Day to Close (Offer to Contract)

-

Clear-title vehicle

-

Why ClaimBuyout? The owner LOVED the vehicle but could not wait for lengthy repairs and chose ClaimBuyout instead.

Buyout: 2016 Nissan Rouge

(Odessa, MO)

- 64% Damage

- $9,000 Purchase Price

- 2 Days to Close (Offer to Contract)

- Clear-title vehicle

- Why ClaimBuyout? The owner was not comfortable getting back into a damaged vehicle and does not feel the repairs will get it back to pre-loss condition.

10-Day Payoff Amount of Your Lien/Loan/Lease Vehicle

- Request the payoff amount for your vehicle by contacting your bank/lender or leasing company. The payoff amount is not the same as looking at your last payment statement

- Ask for a 10-day payoff amount in writing and request what address to use to send the payoff amount.

Release Your Vehicle and Remove Your Personal Belongings

- Call the repair facility or wherever the car is located and verbally release it to allow ClaimBuyout to pick it up.

- Remove all personal belongings from the vehicle as soon as possible.

Personalized, Friendly Service From Someone Who Cares And Understands Your Needs

Introducing Our Customer Experience Team

Each offer is assigned a customer experience team member. Moving with speed and convenience, providing fair market value, and creating a full-service experience, vehicles are purchased within hours—not days. ClaimBuyout manages the vehicle pick up, title, payment, and processing details at no cost to the vehicle owner.

Unlike most companies, we encourage phone calls and emails-we are here to assist you.

Vehicle Vocabulary

-

Pre-Accident Value

The value of your used vehicle directly before the accident happened. However, this does not mean the value it had when it left the car lot.

-

ClaimBuyout Offer

An official offer issued to a vehicle owner to purchase a used, damaged, repairable vehicle.

-

Insurance Adjuster

An insurance company employee or contractor who reviews the damages and injuries caused by an accident and okays claims payments.

-

Vehicle Repair Estimate

A vehicle repair estimate shares the cost to repair a vehicle including parts and labor costs. The reason for the estimation is because there can be unseen damages that will later affect the repair costs; sometimes the mechanic is not aware of a broken part until it is found, which is defined as a supplement to the repair estimate.

-

Supplement

A supplement refers to any additional repairs that are called for outside of the original vehicle repair estimate.

-

Car Title

Legal document establishing proof of ownership. In the US, vehicle titles are commonly issued by the Secretary of State in the state the vehicle was purchased by the Department of Motor Vehicles.

-

Claims Settlement Cycle Time

Property & Casualty (P&C) insurance claim settlement cycle time measures the average amount of time that is required to settle and close an insurance claim–from first notice of loss until the settlement.

-

Deductible

A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss.

-

Lease Vehicles

Vehicle leasing is the use of a motor vehicle for a fixed period of time at an agreed amount of money for the lease.

-

Post-accident Categories: Minor Accident

Vehicle can be repaired.

-

Post-accident Categories: High Impact

Vehicle can be repaired and does not reach the total loss threshold.

-

Post-accident Categories: Total Loss

When the vehicle has such extensive damage that is it too costly to repair or is damaged beyond repair.

Frequently Asked Questions

-

Is there a fee or cost to using ClaimBuyout?

No. We do not charge vehicle owners for our services.

-

How do I get the payoff amount for my vehicle and what do I need to ask?

You can access the payoff amount for your vehicle by contacting your bank/lender or leasing company. You want to ask for a 10-day payoff amount in writing and request the mailing address where to send the payoff amount. Keep in mind this is not the same as looking at your last payment statement.

-

What if I own the vehicle and do not have a loan or a lease? How do I receive my payment directly from ClaimBuyout?

You will need to show ownership and that no lien is on the vehicle. You can determine whether you want to be paid via wire service (ACH) or check. Your ClaimBuyout Customer Experience team member will confirm the details with you as part of the process.

-

How long has ClaimBuyout been in business and how is it managed?

We have been in business since January 2021. We have gone through a rigorous vetting process with your insurance provider to be a referral service to their policyholders. Our management team has 70+ years of combined industry expertise.

-

When do I release the vehicle to ClaimBuyout?

Once you agree to ClaimBuyout's Offer, then your next steps include releasing the vehicle, delivering the title to ClaimBuyout, getting all of your personal belongings out of the vehicle, and working with your Customer Experience Representative to help you through the rest of the process.

-

Why hasn't this service been offered before?

That's a great question. ClaimBuyout is revolutionizing the way people sell their damaged vehicle after an accident and receive pre-accident value. We are the first national company to offer this solution and we are pleased to work with customers from coast to coast.

-

Where can I leave feedback for suggestions and ideas?

We appreciate any and all feedback you may have to share. You will receive a survey link at the end of the process. Feel free to share any further kudos or comments on social media as we continue to build the ClaimBuyout community. Thank you!

-

Does GAP Insurance apply in these circumstances?

Unfortunately, GAP Insurance does not apply in this case, as the vehicle is considered repairable, not a total loss.